For Entrepreneurs, Business Owners,

Start-Ups And Investors

Learn How To Secure $50K-$150K In Funding

At 0% Interest Quickly To Grow Your Business

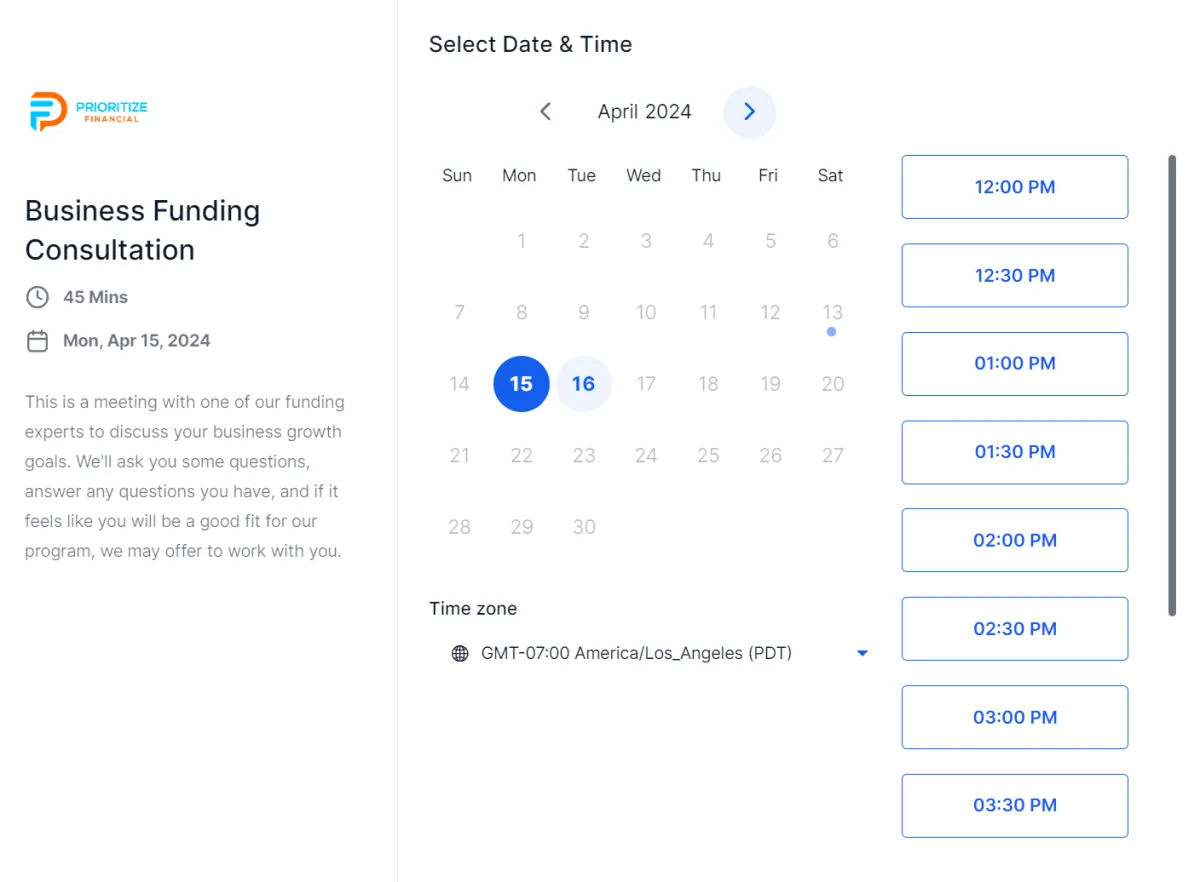

Schedule a FREE Call Below To See If You Qualify

Get $50,000 Or More Quickly

Using Our Proven Fast Funding Formula

For Business Owners

Secure 0% interest capital without showing any proof of income documents, collateral, or giving up equity shares.

Optimize Your Credit Profile

Utilize Our Lender List

Leverage Our Network Of Bank Managers

Apply Secret Data Points

Funds Delivered Fast

Grow Your Business

Secure Predicatble 0% Interest

Funding In As Little As 14 Days

Schedule a call

Meet with one of our funding experts. We'll go over your credit report and your business goals, to see if you'll be a good fit for our program.

Optimize Your Credit Profile

We help you to optimize your credit profile to ensure that you meet each lender's exact underwriting qualifications.

Secure a round of high-limit funding

Using precise data points, we submit your applications through our network of bank managers, ensuring you are approved for the highest possible limits.

Basic Requirements

Must have good standing personal credit. 700 minimum FICO score (720+ is ideal). If you're not there, we can help you fix your credit and optimize it for funding.

Must have an active business bank account. If you don't have a business, we can help you get set up. You can get much more funding with a business.

The location and operation of the business must be in the US.

Must not have an active bankruptcy.

Must not have any defaults with a previous lender.

If you have a tax lien, it must be on a payment plan.

Frequently Asked Questions

How Much Funding Can I Get?

The amount of funding we secure will depend on many factors, including your personal credit report, business information, and revenue or projected revenue. It’s common for clients to receive $50,000- $250,000 initially. Additional rounds of funding can yield $500,000 or more. Adding business tradelines and applying with aged corporations can boost these numbers substantially. Our process can be duplicated to $1MM or more.

How Long Does It Take To Get Funding?

This depends on many factors. After we review your credit report, if you're eligible for funding immediately, you can receive funding in 14 days or less. If there is work to do on your credit profile, it can take 4-6 weeks. If you have negative accounts that require credit repair, it can take 2-4 months.

How Much Is The Investment?

If we decide to work together, we will take an upfront deposit/retainer to start the process. After you receive your funding we will send a performance-based invoice which is a percentage of the total amount of funding you received. For example, a 10% performance fee on $50,000 funded is $5000. Your fee can vary, and will be based on your personal credit report, your business revenue, or expected reveunue, and other factors. If you don't receive any funding, you don't pay us anything.

Do You Need To Use My Personal Credit Report For The Application?

Yes. Even though you may be applying for business credit, lenders still refer to your personal credit for their decision-making.

Will The New Business Credit Show Up On My Personal Credit Report?

No. We only work with lenders that report to business credit profiles, not personal ones.

Can I Get EIN Only Funding?

It’s possible to get funding with just an EIN, but you’ll need to have substantial business revenue already.

What If I Have Bad Credit?

Our credit repair accelerator program is specifically designed to get your credit report ready for funding. We've helped 100s of clients to fix and rebuild their credit for funding. Please book a call with our team to learn about the program.

© Copyright 2025 – Prioritize Financial